The timing of the grants early in the tax year means that individuals might have to forecast their total taxable profits for 2020-21 so they can estimate the amount of tax and National Insurance due on the grant. WI Department of Revenue 608 266-2772 DORWeAreAllInwisconsingov.

The Families First Coronavirus Response Act Summary Of Key Provisions Kff

The COVID-related Tax Relief Act of 2020 enacted December 27 2020 amended and extended the tax credits and the availability of advance payments of the tax credits for paid sick and family leave under the FFCRA.

Tax free covid grants. State and territory grants issued to small businesses in response to COVID-19 will continue to be tax-free under a new bill introduced into Parliament. Treasury Laws Amendment 2020 Measures No. Tax NIC and Covid grants.

So if you were able to get the stimulus check last year or early this year for the second round you already. The Restaurant Revitalization Fund RRF will provide 286 billion in grants for eligible restaurants and. EDT 1 Min Read The Internal Revenue Service released a set of frequently asked questions to explain how students colleges and universities should report emergency financial aid grants related to the COVID-19 pandemic.

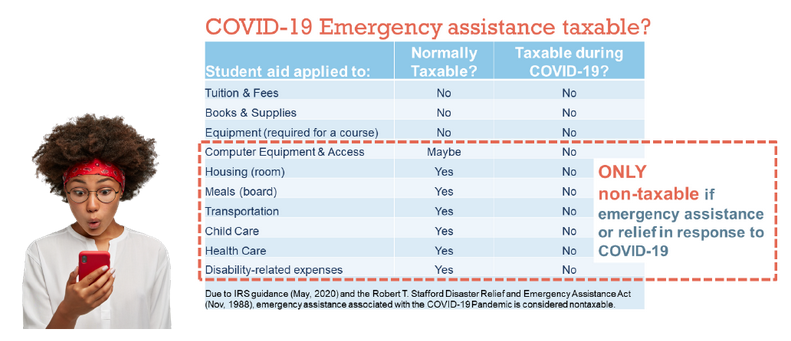

April 12 2021 - Restaurants and bars among the businesses hit hardest by the COVID-19 pandemic will soon be able to apply for a new tax-free grant program enacted as part of the recently enacted American Rescue Plan Act of 2021 signed into law on March 11 2021. If students used any portion of the grants to pay for qualified tuition and related expenses on or before December 31 2020 they may be eligible to claim a tuition and fees deduction or the American Opportunity Credit or Lifetime Learning Credit on their 2020 tax return. Were All Innovating Contest.

See Higher Education Emergency Grants Frequently Asked Questions. In an effort to stave off economic devastation caused by the COVID-19 pandemic billions of dollars in grants are being handed out to individuals and businesses by the federal government and by state and local governments as well. Amounts are taxable or non-assessable non-exempt income.

How do we treat the various grants etc received for business clients with non 313 or54 year ends. Were All In For Wisconsin Restaurants. For many this is likely to be 20 tax and nine per cent Class 4.

Tax-free treatment of COVID-19 grants to be extended. Keeping the system fair. The changes to the income tax law apply to the 202021 income year and later income years under the Treasury Laws Amendment 2020 Measures No.

The Federal Government are offering tax free grants but there is no detail on the Vic grants. Claim the fifth grant if you think that your business profit will be impacted by coronavirus COVID-19 between 1 May 2021 and 30 September 2021. Were All In Small Business Grant Program - Phase 2.

IRS offers guidance to students schools on tax-free COVID grants By Michael Cohn March 31 2021 551 pm. You can get immediate access to the credit by reducing the employment tax deposits you are otherwise required to make. Additional support during COVID-19.

Grants to small businesses. Government grants and payments during COVID-19. Government grants payments or stimulus you receive if you or your business has been impacted by COVID-19 may have tax implications.

The federal government has made small-business grants relating to the recovery from the coronavirus crisis tax-free under new legislation that has passed Parliament. WI Economic Development Corporation 608 210-6700. Are the Business Support grants being offered by the Victorian State government during the Covid-19 pandemic to be treated as income and therefore taxable.

COVID-19-related grants to individuals are tax-free under the general welfare exclusion. Are these grants taxable. View the Income Tax Assessment Eligible State and Territory COVID-19 Economic Recovery Grant Programs Declaration 2020 here.

If you feel an individual or business is not acting within the guidelines of the COVID-19 measures you can make a tip-off to us. Nearly half of self-employed workers are not aware that COVID-19 grants should be declared in future tax returns. It is not taxable income it is essentially a credit Wilson said.

New LawsCOVID-19-Related Government Grants. Were All In Small Business Grant Program - Phase 1. Only entities with an aggregated turnover of less than 50 million will be eligible for the concessional tax treatment.

5 Bill 2020 has entered Parliament as the government looks to realise its budget. The government has taken steps to realise another budget promise by introducing legislation into Parliament to ensure COVID-related small-business grants are treated as non-assessable non-exempt income for tax purposes. Use this information to find out if.

Were working hard to maintain the integrity of the COVID-19 stimulus measures. Government grants and payments during COVID-19. Grants to small businesses.

You need to include the amounts in your tax return and where to include them. Didnt find your answer. Emergency financial support such as the Self-Employment Income Support Scheme.

TaxCompliance Jotham Lian 21 June 2021 1 minute read. COVID-19-related grants to businesses do not qualify as tax-free. Visit COVID-19 compliance measures.

Government Support Schemes For Individuals And Businesses Covid 19 Bdo

Indonesia Measures In Response To Covid 19 Kpmg Global

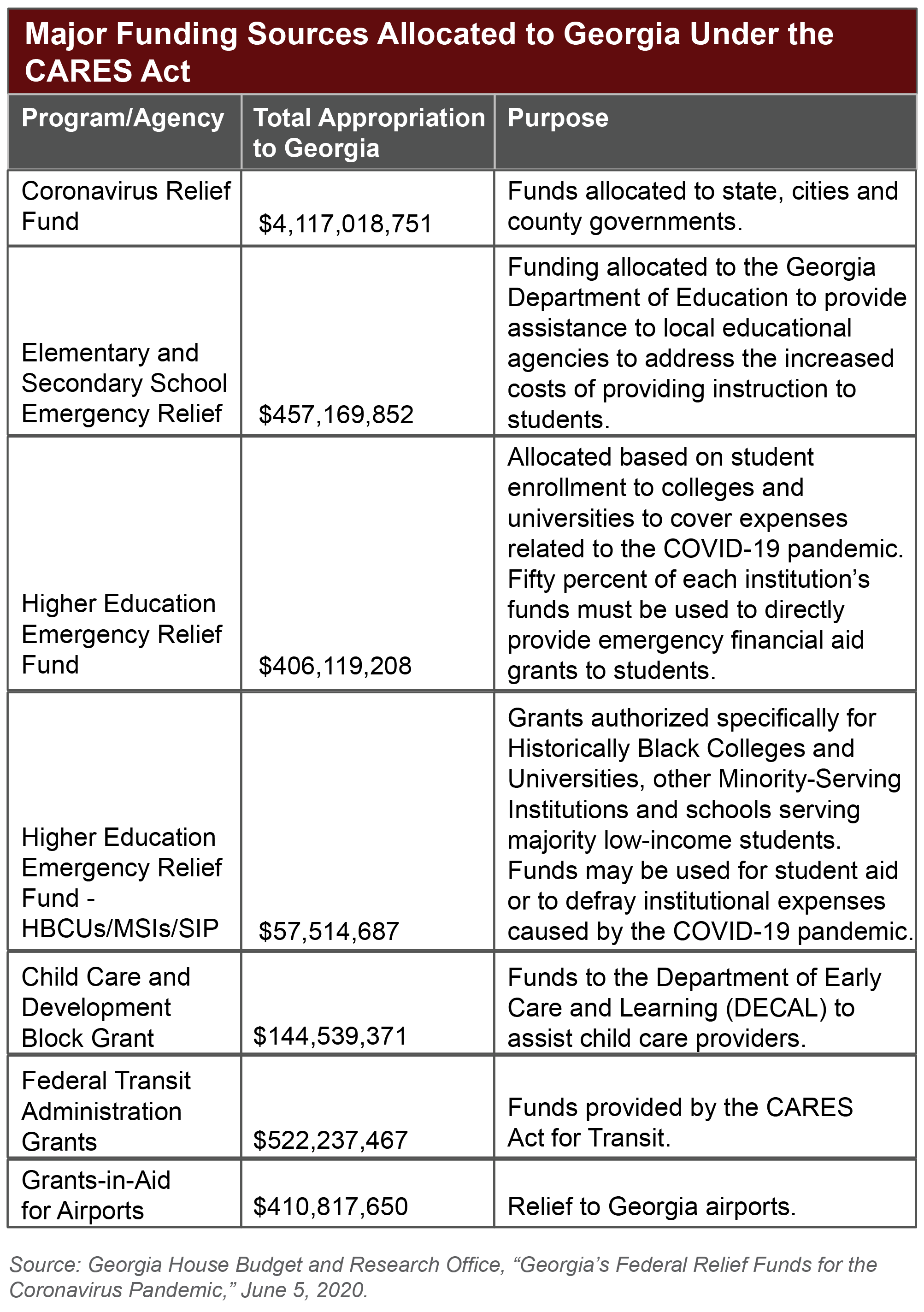

Georgia Revenue Primer For State Fiscal Year 2021 Georgia Budget And Policy Institute

Covid 19 Response Fund San Antonio Area Foundation

Covid 19 Funding Financial Assistance Pidc

Covid 19 Grants And Funding For Health Care Sector

Creating Jobs And Rebuilding Our Economy 2021 22 Budget

Covid 19 Business Resources Lebanon Valley Pa Chamber Of Commerce

The Big Questions About Scholarship Taxability Scholarship America

Covid 19 Related Government Grants Taxable Or Not

Tax Credits And Coronavirus Low Incomes Tax Reform Group

Ifrs Government Grants Grant Thornton Insights

Coronavirus Seiss Fourth And Fifth Grants Low Incomes Tax Reform Group

Tax Advantages For Donor Advised Funds Nptrust

Vermont Department Of Taxes Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Department Of Taxes